Average family ‘could see council tax rise by £120 a year’

Council tax hike ‘will heap misery on struggling households’

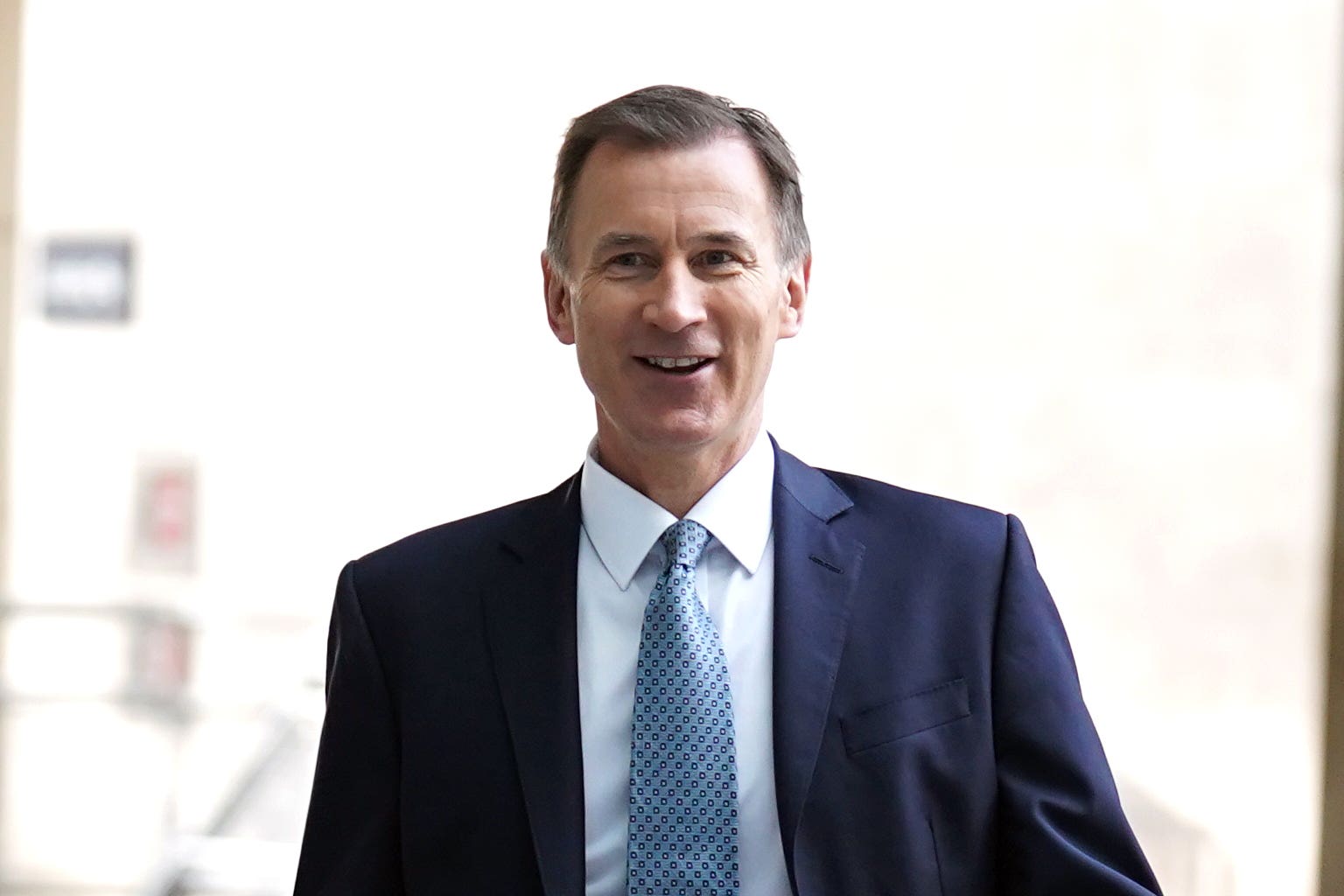

Chancellor Jeremy Hunt is under pressure to lower taxes

The average family could be expected to pay £120 more a year in council tax despite Jeremy Hunt’s plans to cut inheritance tax in half for the UK’s richest households, according to reports.

The Treasury will give the green light for local councils to hike their bills by as much as 5 per cent from April next year despite calls from Tory MPs to cut taxes before the general election, according to The Telegraph.

At the same time, Jeremy Hunt is reportedly considering cutting inheritance tax in half during his autumn statement on Wednesday. The chancellor has been handed a financial boost as official forecasters told the Treasury it has more money in the budget than was expected.

Conor Holohan, of the TaxPayers’ Alliance, said of the council tax plan: “This news will heap misery on struggling households.

“On top of the tax burden already reaching a 70-year high, taxpayers are now staring down the barrel of inflation-busting local rate rises. Town hall bosses should slash local waste and stop council tax rises.”

Rutland Council last year charged Band D households the highest rates of council tax in the country, of £2,365.56. If given the green light, local council and police and fire services could raise their bills by more than £120 to £2,486.32.

More councils fear they could follow Birmingham into insolvency in the face of rising costs for children’s social care

Birmingham City Council - the country’s largest authority - remains on the verge of bankruptcy, blaming £760m of equal pay claims, the expenses of a new IT system, and funding cuts by successive Tory governments.

The authority has a budget shortfall of £87m – projected to rise to £165m in 2024/25. Among its assets now at risk of being sold are the city’s Central Library, Birmingham Museum and a stake in Birmingham airport.

The TaxPayers’ Alliance, recently found the disparity between wages and council tax meant some UK residents had been landed with a burden five times heavier than others.

West Devon faced the highest council tax to salary ratio, with the average Band D council tax of £2,347 more than 10 per cent of the median gross pay of £21,639, the analysis found.

Nottingham came in a close second, where the average council tax bill of £2,412 is 10.84 per cent of local average earnings of £22,243, followed by Pendle in Lancashire, and Torridge in northwest Devon.

It came as more than 16 million people missed payments on key household bills this year with more than two million doing so for the first time, according to estimates from The Money and Pensions Service.

Credit card repayments were the most common type of bill that went unpaid, followed by utilities, council tax and bank overdrafts or loans. Some people, meanwhile, missed rent or mortgage payments.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies